Nonprofit hospitals are under fire, with policymakers and special interest groups questioning whether these institutions provide enough “charity care” to justify the $28 billion they receive in annual tax exemptions.

This narrow focus is misguided and ignores the bigger picture: Nonprofit hospitals, in particular academic health systems, provide much more than charity care.

Research and training, without which our nation’s health care system would quickly decline, are a vital part of the IRS-defined “community benefit,” beyond charity care, that nonprofit hospitals provide. Academic health systems also deliver critical services — like Level I trauma centers, burn units, and psychiatric care — that for-profit hospitals and health systems largely avoid.

At the AAMC, we have been relentless in our advocacy to uphold the tax-exempt status of the nation’s nonprofit teaching hospitals. "We strive every day to meet not just the letter of the law, but the intent of the law, and that goes far beyond providing care for the uninsured,” says Atul Grover, MD, PhD, executive director of the AAMC Research and Action Institute.

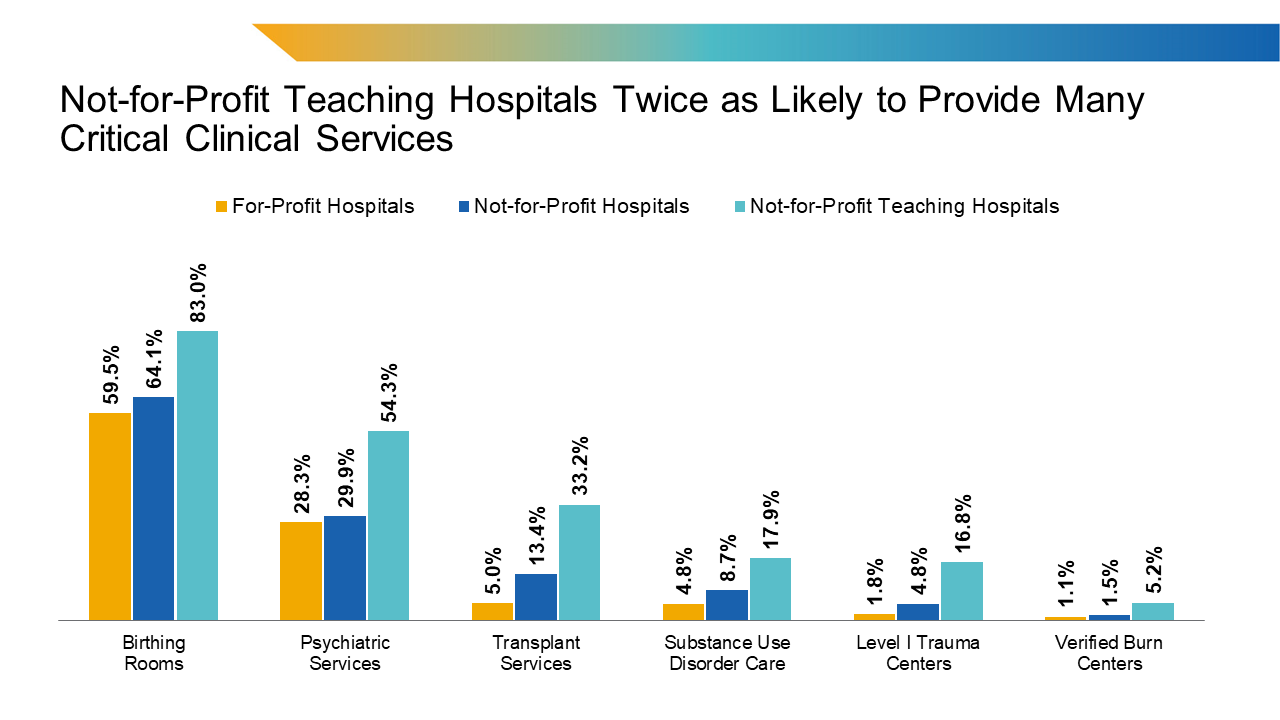

In fact, the institute recently published research into the little-understood benefits of nonprofit hospitals. “Clinical Benefits of Not-for-Profit Health Systems Beyond Charity Care” found that not-for-profit teaching hospitals are much more likely than for-profit hospitals to offer a range of complex, essential services, including birthing centers, psychiatric services, transplant centers, substance use disorder clinics, Level I trauma centers, and burn units.

For instance, 54.3% of not-for-profit teaching hospitals offer psychiatric services, compared to just 28.3% of for-profit hospitals. Likewise, 17.9% of not-for-profit teaching hospitals offer substance use disorder care, versus 4.8% of for-profit hospitals.

So why don’t for-profit hospitals offer more of these specialized services? Because many, if not most, of these services lose money every year.

Consider this: You’re in a terrible car accident and flown to a Level I trauma center. Once there, you undergo emergency surgery that saves your life.

That Level I trauma center is what’s considered a “standby service” — highly trained doctors, nurses, and respiratory therapists are standing by to provide care 24/7, whether you need them or not. And when you don’t need them, the hospital still pays their salaries and maintains the high-tech equipment and facilities needed to support them.

“Not-for-profit teaching hospitals provide critical services for patients and their families, and communities benefit broadly from the presence of these services, not just the minority of people who are uninsured,” says Grover. “As policymakers explore cuts to nonprofit institutions, through changes to tax status or cuts to other subsidies, they must consider how eliminating these investments will affect the clinical services that patients across the country rely on.”

Burn centers. Transplant centers. Inpatient psychiatric care. Substance use disorder care. All are clinical services provided primarily at nonprofit hospitals — and most often at major academic teaching hospitals — that often operate at a loss, but that tax exemptions help subsidize.

Academic health systems incur additional financial losses, including from disproportionately higher numbers of Medicare and Medicaid patients, whose reimbursement rates are lower than privately insured patients. In fact, Medicare covered less than 84% of average hospital costs in fiscal year (FY) 2020, whereas Medicaid covered 88% of average hospital costs that year. What’s more, the Centers for Medicare & Medicaid Services has proposed a 2.8% pay cut for physicians in 2025. That follows a 1.69% Medicare pay cut in 2024 and a 2% cut in 2023. In total, Medicare physician payment has declined by 29%, adjusted for inflation, from 2001 to 2024.

Academic health systems also incur the costs of training the next generation of physicians. Each year, AAMC-member institutions train approximately 77,000 residents nationwide, making them the primary producers of both primary care and specialty physicians. Of these residents, Medicare offsets a portion of the costs for approximately 57,000 trainees. Additionally, AAMC-member teaching hospitals fully cover the costs of training the remaining 20,000 residents without any support.

In a written response to the House Ways and Means Committee Republican Tax Teams in October 2024, Danielle Turnipseed, JD, MHSA, MPP, AAMC chief public policy officer, outlined the additional costs incurred by AAMC-member nonprofit academic health systems and teaching hospitals. “As the Tax Committee Teams debate revisions to federal tax policy, we urge you to work with stakeholders to consider targeted revisions to the Internal Revenue Service (IRS) Form 990, Schedule H, develop a more comprehensive definition of community benefit, and reject the elimination or restriction of the tax-exempt status of non-profit hospitals,” she wrote.

Training the future physician workforce. Caring for the sickest, most vulnerable, most medically complex patients. Offering a range of essential, low- or no-margin services, including desperately needed psychiatric care, trauma and burn centers, and birthing rooms.

These are the services provided by nonprofit hospitals, particularly AAMC-member nonprofit teaching hospitals, that go far beyond charity care but that would not be possible without the tax exemptions provided to these hospitals.

At the AAMC, we will continue to advocate to maintain the nonprofit status of AAMC-member academic health systems and teaching hospitals.

We urge you to engage with your congressional delegation, educate them on the unique role and missions of academic medicine, and explain the potential impact on patients and communities should academic health systems and teaching hospitals lose their tax-exempt status.